|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding Fixed Home Equity Loans for Financial StabilityWhat is a Fixed Home Equity Loan?A fixed home equity loan is a type of loan where the borrower uses the equity of their home as collateral. This loan type allows homeowners to borrow a lump sum of money at a fixed interest rate, which means the monthly payment remains constant over the life of the loan. Key Features of Fixed Home Equity LoansFixed Interest RateThe primary benefit of a fixed home equity loan is its fixed interest rate. Unlike variable rates, this ensures that your monthly payments will not change, providing financial predictability. Lump Sum PaymentBorrowers receive the entire loan amount upfront in a single lump sum, which can be particularly useful for major expenses such as home renovations or consolidating debt. Benefits of Choosing a Fixed Home Equity Loan

Considerations Before Taking a Fixed Home Equity LoanBefore opting for a fixed home equity loan, consider the following:

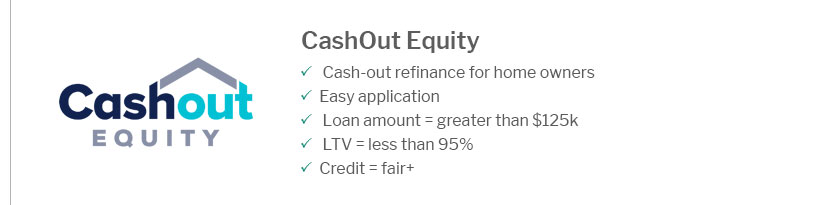

FAQWhat is the difference between a fixed home equity loan and a HELOC?A fixed home equity loan provides a lump sum at a fixed interest rate, while a HELOC (Home Equity Line of Credit) offers a revolving line of credit with a variable interest rate. How is the interest rate determined for a fixed home equity loan?The interest rate for a fixed home equity loan is influenced by the borrower's credit score, the loan-to-value ratio, and current market rates. Can I use a fixed home equity loan for any purpose?Yes, funds from a fixed home equity loan can be used for various purposes, including home improvements, education, and debt consolidation. ConclusionFixed home equity loans offer a stable and predictable financial solution for homeowners seeking to leverage their home's equity. By understanding the benefits and considerations, you can make an informed decision that supports your financial goals. https://www.dcu.org/borrow/mortgage-loans/home-equity-loans.html

A DCU Fixed-Rate Equity Loan or Home Equity Line of Credit (HELOC) gives you the ability to borrow against your home's equity to pay for major purchases, home ... https://www.langleyfcu.org/home-equity

Fixed rate HELOCs start as low as 5.99% for 7 years. [1] You never have to worry about increasing rates! There is no minimum balance required. https://www.wellsfargo.com/equity/

Unlock your financing options with a cash-out refinance. Get a rate quote. Understanding Home Equity: Building and Benefits. Whether you're ...

|

|---|